Gold has shattered expectations in 2025, and as of this writing, the spot price is $3,432 an ounce. J.P. Morgan Chase predicts it could top $4,000 an ounce by mid-2026. If you’re wondering how to buy gold and get started with precious metals, this article covers the steps you need to know.

Steps to buy gold bars and coins

The short version on how to buy gold bars and coins is:

- Decide your budget: Choose how much of your portfolio to put into gold.

- Pick your form: Coins work for smaller and easier-to-sell amounts. Bars have lower premiums and can be easier to store.

- Select a reputable dealer: Check BBB ratings and reviews, and ask for authenticity certificates.

- Plan your storage: Decide where to store your gold, like in a home safe, bank box, or insured depository.

- Understand costs: Premiums versus spot pricing, storage fees, and possible taxes.

- Make your purchase: Buy and keep documentation for authenticity and resale.

Understanding gold investments

If you’re looking at buying gold, you have a few different options:

- Physical gold: Coins and bars give you direct ownership and tangible security. You control your assets completely, which makes owning this yellow metal an excellent hedge against economic uncertainty.

- Gold ETFs: Exchange-traded funds are publicly traded on the stock market and give you shares in a pool of gold bars. They provide liquidity and low entry costs, but you do have counterparty risk since you don’t physically control the metal. Also note that Gold ETFs can charge an expense ratio that reduces overall returns for investors.

- Gold IRAs: These retirement accounts let you hold physical gold in tax-advantaged retirement accounts. You get to diversify your portfolio and benefit from potential tax deferrals and growth in gold prices.

- Mining stocks: Gold mining companies give you exposure to gold prices. When gold goes up, their profits often grow, which can mean better returns for you. The flip side is you’re also counting on the company to run things well, which is why gold mining stocks tend to be more volatile than investing in physical gold or gold ETFs.

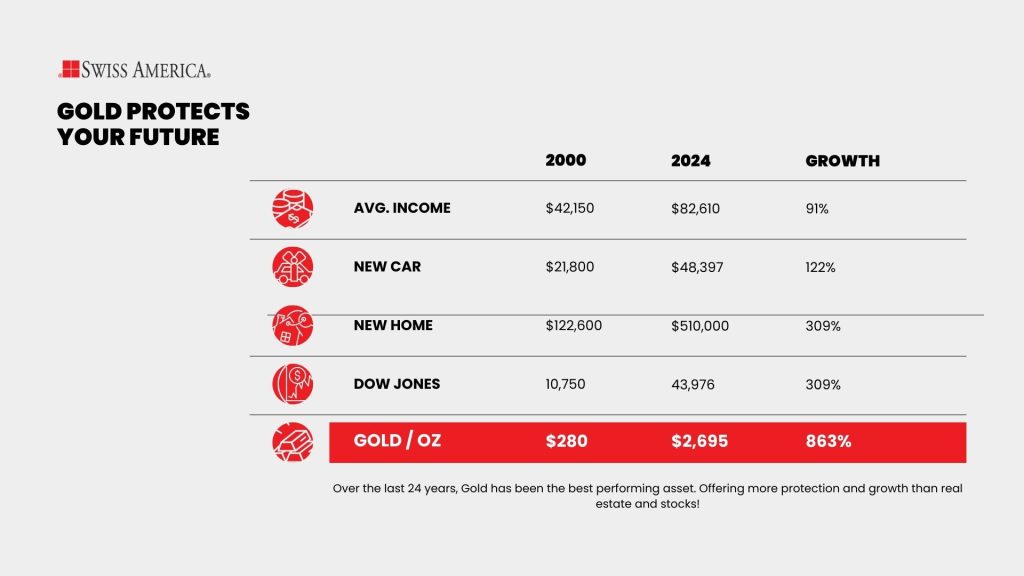

Gold deserves a place in your portfolio for several reasons. Financial advisors usually recommend allocating 5-10% of your holdings to gold as a way to preserve wealth. Gold coins or bars can be your insurance policy against inflation, currency devaluation, and market volatility.

During economic uncertainty, gold often moves in the opposite direction of stocks and bonds, giving you a diversified asset. It’s especially valuable when central banks print money aggressively or geopolitical tensions rise. Paper currencies can lose value overnight, but there’s only so much gold in the world, which gives it intrinsic worth across cultures and countries.

What drives gold prices?

Gold prices move based on a mix of global factors like supply and demand, interest rates, currency values, and investor sentiment.

The spot price comes from real-time market sentiment. It’s a market price from trading activity across major exchanges like London and New York. Gold is a precious metal that responds to macroeconomic uncertainty, currency fluctuations, and geopolitical tensions.

Key market drivers:

- Supply and demand: UBS forecasts that central banks will buy 1,000 metric tons in 2025, while mining output slightly declines due to increased labor and energy costs from inflation.

- Economic indicators: Inflation expectations, interest rates, and the strength of the dollar all directly impact gold prices. As of April 2025, 62% of consumers say the cost of goods and services they need or want keeps going up.

- Seasonal patterns: Traditional strength during Q4 holidays and the Chinese New Year drives cyclical demand for gold jewelry. So far in 2025, demand is 30% lower than the five-year quarterly average due to the higher cost of gold.

- Basel III Impact: In July 2025, new banking rules classify gold as Tier 1 status, treating gold like cash or government bonds. This gives banks a stronger reason to buy and hold more gold bullion.

| Market driver | Details |

| Supply and demand | Central bank purchases and mining output trends shape supply balance. |

| Economic indicators | Macroeconomic factors influence gold’s appeal as a safe-haven asset. |

| Seasonal patterns | Cultural events and holidays create cyclical demand for gold jewelry. |

| Basel III impact | Regulatory changes may increase bank gold holdings. |

Benefits of physical gold

Key benefits of owning gold include:

No counterparty risk

Owning physical gold puts you in direct control of part of your wealth. You’re not relying on a third party to honor a promise or keep digital records intact. The metal is yours, and you can take possession of it whenever you want.

Store of wealth

Gold’s appeal is more than price charts. Across cultures and centuries, people have trusted it to hold value through wars, currency collapses, and economic resets. It holds its worth without depending on banks or governments. Coins and bars can be passed down for decades, carrying their financial value and a tangible connection from generation to generation.

Inflation hedge

Inflation hits hardest when your income or savings can’t keep up with rising costs. Physical gold reacts differently because it’s priced globally, not just in U.S. dollars. If the dollar weakens, gold often adjusts upward to match what buyers in other currencies are willing to pay. That adjustment can help keep the value of your holdings in line with the cost of living, even when prices for essentials climb.

Portfolio diversification

Physical gold works best as part of a mix, not as your only investment. Many financial advisors say you should keep 5% to 10% of your portfolio in gold, with the rest in assets like stocks, bonds, or real estate. This allocation can support overall results without cutting into growth potential from other investments. It’s a good idea to set a target percentage and rebalance periodically to keep your portfolio on track.

Buying gold coins or bars

When you’re ready to buy physical gold, you’ll need to decide whether to get coins, bars, or both. The best path is to buy them from a reputable gold dealer. This path means your gold coins or bars ship with an assay certificate that verifies the gold’s authenticity, purity, and weight.

Gold bullion coins

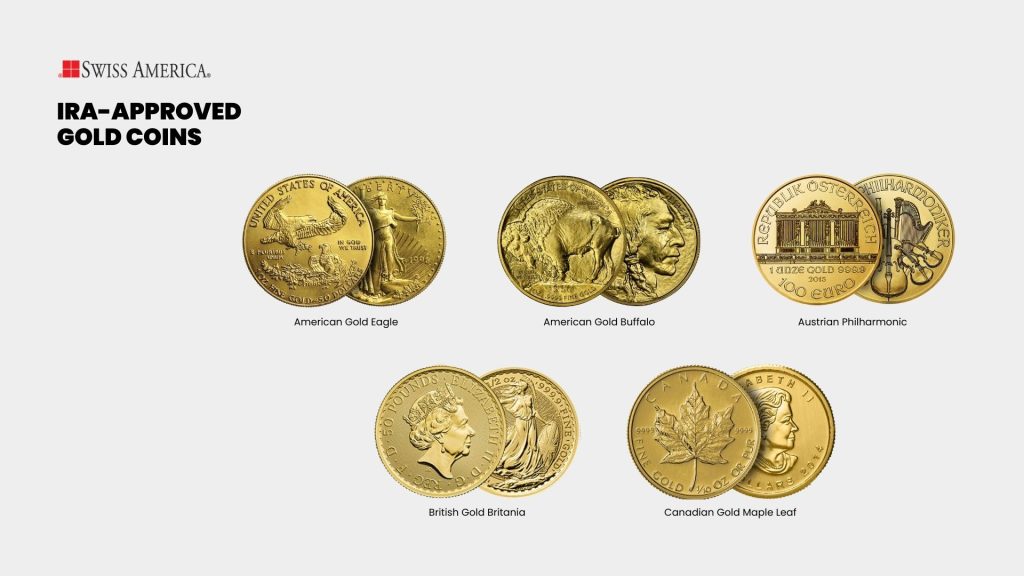

You can buy all kinds of gold coins, but to keep things simple, we’ll look at the most common ones that qualify for a Gold IRA.

- American Gold Eagle: The U.S. Mint has been producing these 22-karat gold coins since 1986.

- American Gold Buffalo: Also from the U.S. Mint, but these gold coins have a higher purity at 99.99%. They’ve been available since 2006.

- British Gold Britannia: Made by the UK Royal Mint, these gold coins are 24-karat gold.

- Austrian Philharmonic: The Austrian Mint produces these gold coins.

- Canadian Maple Leaf: The Royal Canadian Mint manufactures these 99.99% pure gold coins.

Gold bars

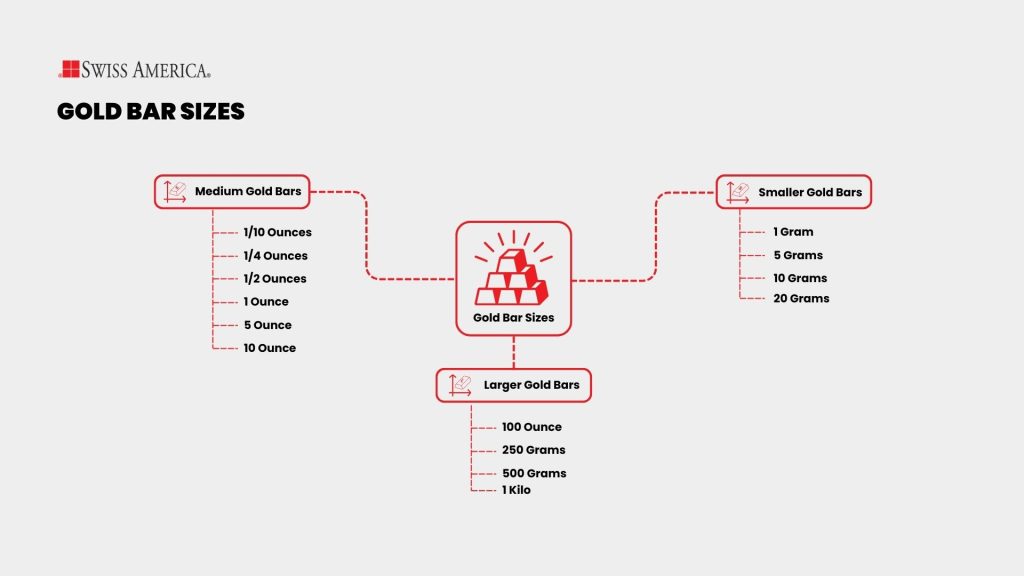

If you’re looking to buy gold bars, here are some of the most common sizes:

- 5 grams

- 10 grams

- 20 grams

- 50 grams

- 100 grams

- 1 ounce

A quick note about the differences between buying gold bars and coins. Bars often have lower premiums and take up less storage space, which can make them more cost-effective. Coins can be easier to sell in smaller amounts and may have wider recognition among buyers, which can help with liquidity.

Considerations of physical gold investing

Factors to keep in mind when buying gold coins or bars:

Storage and insurance

Gold investors have to consider storage options and costs as part of overall decision-making. Options for storage include:

- Home storage: With this approach, you have physical possession of your gold, but you should keep your gold assets in a secure or safe place. You’ll also need to check with your insurance company on coverage options and costs.

- Bank safe deposit box: Some people keep their gold bullion in a bank vault, which can increase security. However, note that gold coins and bars do not fall under FDIC insurance.

- Precious metal depository: These facilities have enhanced security and built-in insurance, but have increased costs to consider as part of your overall returns.

| Storage method | Security level | Annual cost | Insurance coverate | Accessibility |

| Professional vaults | Highest (24/7 monitoring, biometrics) | 0.5-1.5% of value | Full replacement value | Business hours only |

| Bank safe deposit boxes | High (bank security) | $50-300/year | Limited/none | Bank hours only |

| Home storage | Variable (depends on setup) | One-time safe cost | None (check homeowner’s policy) | 24/7 immediate |

Liquidity

Gold can be easy to sell, but it’s not as quick as paper assets like gold mining stocks or ETFs. You’ll need to work with your gold dealer to get a buyback quote, ship your metals to them for inspection and verification, and then receive the proceeds. The entire process can take a few weeks, and then the amount you receive is the bid-ask, which is the difference between the spot price and the dealer’s buyback price.

Taxes

The IRS classifies gold as a collectible, so if you buy it outside of a retirement account and make a profit when you sell, you’ll owe at least 28% in capital gains tax. Holding gold in an IRA can help reduce that tax burden. Also note, depending on where you live, you may also need to pay sales tax on your physical gold investment.

Finding a reputable dealer

Work with a reputable dealer to make sure you’re buying legitimate gold or precious metal products. For any dealer you’re considering, check:

- Better Business Bureau ratings

- Industry association memberships

- Customer reviews and testimonials

- Physical address verification

Always request certificates of authenticity, and reputable dealers provide transparent pricing, secure shipping, and buyback policies.

Final thoughts on buying gold

Gold bars and coins are a strong defense against the next crisis or economic issue. To learn more about gold investing, connect with the Swiss America team today!

How to buy gold: FAQs

How do beginners buy gold?

Work with a reputable gold dealer who can explain different coins and bars and help match them to your budget and goals.

How much is 1 oz of gold?

As of this writing, the current spot price of gold is $3,491/oz.

Can I buy $100 worth of gold?

You can buy gold in small quantities at the current price per ounce plus dealer premiums, but it’s hard to get exactly $100 worth. You might end up spending more, so check with a dealer to see what options are available. You could also consider other metals like silver or platinum.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.