Are purchases of gold and silver tax-free? Sadly, no. But knowing what taxes you can expect helps you understand how much bullion you can buy. This article covers sales tax on gold and silver by state so you can factor those costs into your investment decisions.

As of this article update, the spot price of gold is now $3,500/oz. If you’re looking to buy gold, your price won’t be $3,500/oz… it will be more. You’ll have a premium above spot that covers the manufacturing and distribution costs, and most reputable dealers like Swiss America provide transparency around this pricing.

But you may also have to pay a sales tax, depending on where you live. The good news for Swiss America customers is that we always provide transparent pricing, so when you go to buy, you won’t have surprises.

Overview of sales tax on precious metals

There are two possible taxes you might pay on precious metals:

State sales tax

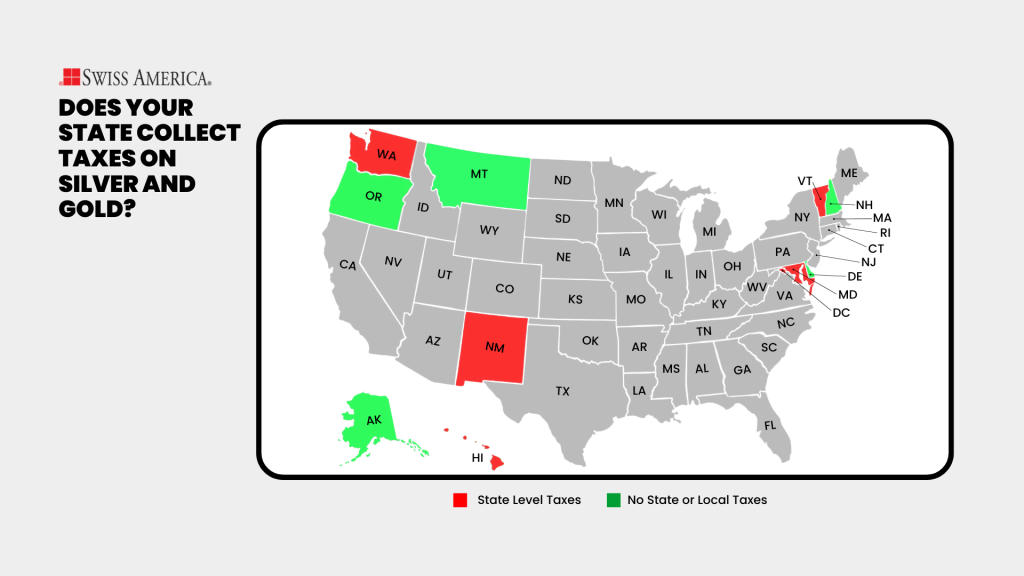

Some states charge sales tax on precious metals, but there are only five that do this today, including Hawaii, New Mexico, Maryland, Vermont, and Washington.

If you live in Washington, DC, you’ll also have online sales tax for your metal purchases.

Local sales tax

You’ll almost always need to pay local sales tax unless you live in Alaska, Delaware, Montana, New Hampshire, or Oregon.

State-by-state analysis

The specific regulations for each state include:

Alabama

Alabama currently does not have a sales tax on precious metals. SB 13 passed in 2019 and provides this exemption through 2028.

Do you pay local taxes? Yes

Alaska

The state of Alaska doesn’t have a statewide tax on precious metal bullion.

Do you pay local taxes? No

Arizona

There is no statewide tax on precious metals.

Do you pay local taxes? Yes

Arkansas

Arkansas passed a law effective October 1, 2021, that exempts sales tax on gold and silver bullion products. The state also made gold and silver legal tender so that citizens could use bullion coins to pay for goods and services.

Do you pay local taxes? Yes

California

Effective July 1, 2023, the state does not collect sales tax if you buy gold and silver at values above $2,000. If the value of your investment is less than this sales price, then you will have to pay a sales tax.

Do you pay local taxes? Yes

Colorado

Colorado does not collect sales tax on precious metals, but this doesn’t include all numismatic coins. Check the state bulletin for definitions and to understand which metals might still have tax implications.

Do you pay local taxes? Yes

Connecticut

Connecticut residents who spend less than $1000 on precious metals purchases pay a 6.35% tax. If you make purchases of gold coins or other precious metals, these purchases do not have sales tax.

Do you pay local taxes? Yes

Delaware

The state of Delaware does not impose sales taxes on precious metals.

Do you pay local taxes? No

Florida

The state of Florida does not collect sales taxes on precious metals if your purchase is above $500.

Do you pay local taxes? Yes

Georgia

Georgia residents do not pay sales taxes on the purchase of precious metals.

Do you pay local taxes? Yes

Hawaii

At the state level, Hawaii levies a General Excise Tax of 4% on gold and silver bullion purchases.

Do you pay local taxes? Yes

Idaho

Idaho’s statutes exempt gold and silver bullion from sales taxes.

Do you pay local taxes? Yes

Illinois

There isn’t a statewide sales tax for bullion purchases in Illinois.

Do you pay local taxes? Yes

Indiana

State law specifies that there isn’t an Indiana sales tax on gold if the purchase qualifies for an IRA per IRS rules. U.S. legal tender coins are also exempt.

You may have to pay sales taxes if you purchase collectible coins or bullion that do not meet these standards.

Do you pay local taxes? Yes

Iowa

There is no Iowa sales tax on precious metals. The state also doesn’t have capital gains tax on these investments per House File 659.

Do you pay local taxes? Yes

Kansas

In 2019, the Kansas legislature passed House Bill 2140 which exempts precious metals purchases from sales tax.

Do you pay local taxes? Yes

Kentucky

Kentucky recently passed House Bill 8, which places a tax exemption for gold and silver bullion.

Do you pay local taxes? Yes

Louisiana

The state recognizes that gold and silver bullion is tangible personal property and exempts these investments from sales taxes.

Do you pay local taxes? Yes

Maine

In 2023, Maine lawmakers passed Senate Bill 1051 which exempts precious metals from sales taxes.

Do you pay local taxes? Yes

Maryland

Maryland’s House Bill 352, the Budget Reconciliation and Financing Act of 2025, now applies a 6% sales tax on gold and silver bullion.

Do you pay local taxes? Yes

Massachusetts

Massachusetts has an exemption for gold and silver purchases over $1000 per the state’s statue.

Do you pay local taxes? Yes

Michigan

Michigan residents who buy gold, silver or platinum bullion at 90% or greater purity do not have to pay sales taxes on these purchases per state law.

Do you pay local taxes? Yes

Minnesota

Minnesota state law does not impose sales tax on precious metals that are 99.9% pure.

Do you pay local taxes? Yes

Mississippi

In 2023, Mississippi’s Senate Bill 2862 created sales tax-exempt status for precious metal purchases.

Do you pay local taxes? Yes

Missouri

Missouri’s law exempts the purchase of gold and silver bullion from state and local taxes as long as they meet certain purity requirements.

Do you pay local taxes? Yes

Montana

Montana doesn’t have a state sales tax on any purchases, so there’s no tax on precious metals.

Do you pay local taxes? No

Nebraska

The state of Nebraska does not levy sales taxes on bullion. New laws go into effect on January 1, 2025, to expand the definition of bullion to include bars, ingots, medallions, coins, notes, leaf, foil, and film made of gold, silver, platinum, palladium, or a mix of these metals.

Do you pay local taxes? Yes

Nevada

Nevada law doesn’t levy sales tax on gold or silver bullion as long as you buy them as a medium of exchange.

Do you pay local taxes? Yes

New Hampshire

The state of New Hampshire doesn’t have a statewide sales tax on any purchases do you won’t pay taxes on gold and silver bullion products.

Do you pay local taxes? No

New Jersey

New Jersey’s Senate Bill 721 eliminates sales tax on investment metal bullion and coins.

Do you pay local taxes? Yes

New Mexico

New Mexico residents that buy gold and silver bullion pay a gross receipt tax. This gets added to the price upon purchase and ranges from 5.125% and 8.8675%.

Do you pay local taxes? Yes

New York

There is a New York sales tax of 4% for gold and silver bullion purchases under $1,000. Purchases over this amount are exempt from sales taxes.

Do you pay local taxes? Yes

North Carolina

North Carolina’s law exempts gold and silver bullion products from sales taxes if the value of the bullion is primarily determined by its metal content rather than its form. Starting January 1, 2025, this exemption also applies to coins, leaf, foil, and other forms where value gets calculated on metal content.

Do you pay local taxes? Yes

North Dakota

The state of North Dakota does not have sales tax on gold or silver bullion coins or bars.

Do you pay local taxes? Yes

Ohio

Ohio passed a law under House Bill 110 in 2021 that eliminated state sales tax on precious metals.

Do you pay local taxes? Yes

Oklahoma

The state of Oklahoma does not charge state sales tax on gold or silver.

Do you pay local taxes? Yes

Oregon

Oregon does not levy sales taxes for gold and silver precious metals.

Do you pay local taxes? No

Pennsylvania

Investors in Pennsylvania do not pay sales taxes on precious metal purchases.

Do you pay local taxes? Yes

Rhode Island

The state of Rhode Island doesn’t levy sales tax on silver or gold bullion, legal tender and non-legal tender.

Do you pay local taxes? Yes

South Carolina

South Carolina does not impose sales taxes on precious metals at the state level.

Do you pay local taxes? Yes

South Dakota

In South Dakota, most of the bullion coins or bars sold by Swiss America do not have a sales tax at the state level.

Do you pay local taxes? Yes

Tennessee

In June of 2022, Tennessee’s governor signed HB 1874/SB 1857 which eliminated state sales tax on precious metals. This exemption applies to gold, silver, platinum, palladium bullion products.

Do you pay local taxes? Yes

Texas

Per Texas Administrative Code 3.336, the state does not charge sales tax on precious metals.

Do you pay local taxes? Yes

Utah

There is no Utah sales tax on gold, silver or other precious metals. The state also offers a nonrefundable credit against your Utah state tax if you report capital gains tax on your federal income tax return for U.S.-issues gold and silver coins.

Do you pay local taxes? Yes

Vermont

Vermont does have a sales tax on gold and silver products. The sales tax rate is 6%.

Do you pay local taxes? Yes

Virginia

Investors in Virginia do not pay sales taxes on gold, silver and platinum bullion products over $1,000 per Virginia Code § 58.1-609.1 19.

Do you pay local taxes? Yes

Washington

As of October 1, 2025, Washington state residents must pay the state’s 6.5% sales tax plus any local and county sales taxes.

Do you pay local taxes? Yes

Washington, DC

Investors must pay Washington DC sales tax on gold and silver bullion products.

West Virginia

West Virginia does not have a sales tax on gold at the state level.

Do you pay local taxes? Yes

Wisconsin

Wisconsin’s governor recently signed Assembly Bill 29, which exempts precious metals from sales taxes at the state level.

Do you pay local taxes? Yes

Wyoming

There is no Wyoming sales tax on precious metals per the Wyoming Legal Tender Act.

Do you pay local taxes? Yes

Specific tax considerations

Besides your state-specific rules about sales tax, there’s a few other considerations:

Bullion coins vs. numismatic coins

States may have different rules that define which metals they exempt. Generally, bullion products that qualify for an IRA fall under this exemption if your state has one. But, you might find numismatic coins, which you can’t hold in an IRA, have different tax implications.

Impact of metal content

Some states only waive sales tax if your metals meet certain purity levels. Examples include:

- Alabama: 80% purity.

- Illinois: 98% purity.

- Michigan: 90% purity.

Online retailers and shipping address

For online shopping, sales tax gets calculated based on where you ask the dealer to ship your precious metals. Your billing address is just for verifying the payment and doesn’t usually affect the tax.

Other tax law regulations

Besides potential sales taxes, the other taxes you’ll pay on gold and silver are capital gains taxes.

Capital gains taxes

The federal government requires you to pay capital gains taxes on any gains you make from selling gold and silver at a profit. Most states also impose capital gains tax. The exceptions to this include states that don’t have any income tax, which include:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Wyoming

The amount of capital gains you’ll pay on the sale of gold or other precious metals at the federal level depends on how long you hold the metals and your marginal tax rate.

- Short-term capital gains: If you only hold the metals for less than one year, you’ll get taxed at your ordinary income rate.

- Long-term capital gains: If you hold the metal for over one year, you’ll pay a maximum of 28% because the IRS classifies these investments as collectibles.

Selling regulations

If you are wondering about the IRS and if you the agency knows if you buy or sell gold, here are the details:

- When you buy: The IRS doesn’t track every gold transaction, so they don’t know when you buy gold unless you hold your gold in a tax-advantaged retirement account like a Gold IRA. Since they give you tax benefits….they know about your gold.

- When you sell: When you sell gold and silver, dealers like Swiss America may have to file a Form 1099-B to report your transaction to the IRS. This is usually for larger transactions.

- If you make a profit: If you make a profit, you’ll need to report this income on your tax return as a capital gain.

Sound money and economic impact

People view precious metals like gold and silver as sound money due to their underlying worth. They are a store of value.

Sales tax policies can impact investor’s decisions to invest in these assets. That’s why various gold industry organizations are working with states states lower or eliminate sales taxes on precious metals. These efforts aim to make it easier for investors to protect their wealth.

Is there sales tax on gold bars? Final thoughts

Most of the time, you’ll have some type of sales tax on gold bars. Only three states charge state-level taxes, but local taxes apply in most areas. Five states have no sales tax at all. As long as you know this before you buy, you won’t get caught off guard.

When you go to invest, keep in mind your state’s regulations and any potential taxes you might have on capital gains in the future. You can also consider consulting tax professionals to get an idea of your potential tax consequences.

If you want to learn more about gold, silver or platinum bullion, contact Swiss America today!

Sales tax on gold and silver by state: FAQs

Is gold taxable in the USA?

Most of the time yes. You might have sales taxes at the state and local level plus capital gains taxes. Sales taxes on gold vary by state, and while only three states charge state taxes, there are only five states where no local taxes apply. You’ll also have capital gains taxes if you make a profit when you sell.

How can you avoid sales tax when buying gold?

You can avoid sales tax on gold purchases if you live in Alaska, Delaware, Montana, New Hampshire, or Oregon, since these states do not charge sales tax. In other states, you’ll need to pay local sales taxes, and in three states, you’ll also have state-level taxes on gold purchases.

How much silver can I buy without reporting?

As an investor, you don’t have to report how much silver you buy. But, the dealer might have to report your purchase if it meets certain thresholds like larger purchases. You can always ask your dealer for details to get an idea of this reporting.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.