If you’re wondering how can I transfer my 401k to gold without penalty, you’re not alone. Many people with retirement accounts from a previous employer are looking for ways to move into physical gold without triggering taxes or fees. In fact, 21% of Swiss America customers bought gold or silver with retirement funds in 2025.

Several reasons behind the increasing price of gold include global conflict, tariffs, and a general lack of confidence in the future. When people feel uneasy, they turn to physical gold to protect their money.

This article covers how you can do a Gold IRA rollover and avoid penalties, so you can start protecting your money today.

What is a Gold IRA rollover?

A Gold IRA rollover is when you move funds from an existing retirement account, like a 401(k) or traditional IRA, into a self-directed IRA that lets you invest in physical gold. You are not taking money out of your retirement plan. You’re just shifting it into an account that gives you more control and lets you hold tangible assets like gold coins or bars.

When you follow the right process to move your 401 (k) to gold, you can do this without penalty. There are a few steps to setting up this type of account, but working with a reputable Gold IRA company makes it easy to move over some of your retirement savings.

Why move your 401(k) to gold?

Why do people choose to convert their 401(k) to gold? Here are the most common reasons we see:

1) Portfolio diversification

When it comes to retirement planning, putting all your eggs in one basket can be risky. That’s why many investors want to diversify their assets. Adding gold to your retirement portfolio helps spread your risk across different asset classes.

Gold often moves opposite to stocks and usually does well when the economy struggles. When stocks go down, gold often goes up, or it stays steady. This makes gold a good asset for spreading out investment risk.

Gold can protect against currency devaluation. When the US dollar weakened in the early 2000s, gold prices surged from around $300 per ounce in 2002 to over $1,800 by 2011. This happens because gold is priced in US dollars globally, so a weaker dollar means it takes more dollars to buy the same amount of gold.

2) Inflation hedge

As the value of paper currency goes up and down, investors look for ways to protect their wealth against inflation. Gold has long been considered a potential hedge against rising prices. If you wonder why that is, here’s how a precious metals IRA creates an inflation hedge:

The amount of gold we have is limited, and we only create new supply from mining and recycling. In general, the global gold supply from mining activities increases by about 1-2% annually.

This is different than paper money. The US government adds money to the economy through the Federal Reserve, which buys government bonds. This injects currency into the banking system so banks can lend more, which then increases the overall money supply and leads to inflation.

3) Tangible asset

Physical gold or other precious metals are tangible assets. It’s different from many other investments, like stocks or bonds, because you don’t have to rely on any company or person to fulfill a promise. You simply own the gold itself.

For a stock to be a good investment, the company has to perform. Or if you buy a bond, you need the insurer to pay you back. A huge benefit of gold is that there’s no middleman or third party involved. You have the gold, and the value doesn’t depend on someone else keeping their word.

4) Wealth preservation

Many investors believe gold is a way to preserve value over the long term. Owning physical gold becomes like an insurance policy for their wealth.

If you own gold, you don’t need to check the market every day. You don’t need to see your wealth fluctuate and feel panicked about selling. Gold gives you peace of mind, knowing that you have a way to preserve your retirement savings.

As you approach retirement, you tend to focus on preserving your wealth rather than accumulating it. Gold offers protection against the risks that can eat away at your savings. It helps balance out market volatility so that you can protect a portion of your nest egg when other investments struggle.

5) Retirement income

Gold can be a way for retirees to supplement their income. As your needs change or you have unexpected expenses, you can sell portions of your gold holdings.

Gold doesn’t pay dividends or interest, but it’s relatively easy to sell when you need extra money.

Just like any investment, the timing of your sale can affect your potential gains. The good news for Swiss America customers is that we’ll buy back your gold and help you through the process.

Am I eligible to roll over my 401(k)?

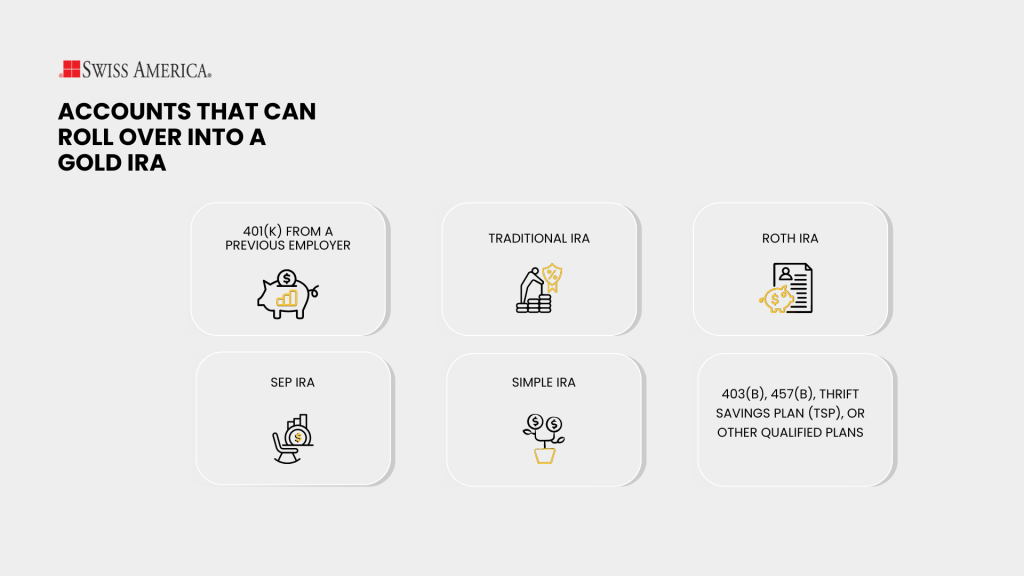

If you already have a retirement account, there’s a good chance you’re eligible to roll it into a Gold IRA. Most rollovers come from:

- 401(k) from a previous employer

- Traditional IRA

- Roth IRA

- SEP IRA

- SIMPLE IRA

- 403(b), 457(b), Thrift Savings Plan (TSP), or other qualified plans

If you’re still working and want to roll over a 401(k) or similar workplace plan, check with your plan administrator first. Some plans don’t allow rollovers until you leave your job or reach a certain age, usually 59½.

401(k) to Gold IRA rollover: step-by-step guide

Here are the five steps to get started with Gold IRA investments:

Step 1: Open a self-directed Gold IRA with a custodian

To open a Gold or precious metals IRA, you work with a Gold IRA custodian. This third-party company manages the account and keeps it in line with IRS rules. They don’t sell you the gold. Instead, they handle the setup and ongoing administration, including:

- Opening your self-directed Gold IRA account

- Processing rollovers or transfers from your current retirement accounts

- Handling the purchase and documentation of your metals

- Making sure the metals go to an IRS-approved depository

- Managing reporting and account maintenance

- Handling sales and withdrawals when you’re ready

Setting up the account includes some paperwork, ID verification, and an initial setup fee.

Step 2: Request a direct rollover from your 401(k)

Contact your employer’s retirement savings plan administrator and request an IRA rollover. You can move all or just a portion of your funds to the self-directed IRA account.

With this Gold IRA rollover process, your retirement plan administrator sends the funds straight to your new Gold IRA custodian. You never touch the money, and there’s no tax withholding. This is the cleanest and most common option to avoid tax penalties.

Step 3: Funds transfer to the new IRA

Your employer plan administrator sends your retirement savings to your Gold IRA company. Once they receive the funds, you’re ready for step four.

Step 4: Buy IRS-approved gold or precious metals

The IRS has specific requirements for what types of metals you can hold in your Gold or precious metals IRA. The metals must come from approved manufacturers or government mints and meet certain purity levels. If the metal doesn’t meet these standards, it’s not allowed in your account.

Your precious metals dealer and your Gold IRA company can advise you on what qualifies.

Step 5: Store your precious metals in an approved depository

If you’re holding physical gold in an IRA, you can’t keep it at home. IRS rules require your Gold IRA custodian to arrange for storage at an approved depository. These are secure facilities that meet the standards for retirement accounts.

Your custodian will handle the logistics and help you choose between segregated or non-segregated storage. The choice here is whether you want your gold coins and bars stored separately or alongside others.

These depositories also include insurance for your precious metals against theft, damage, or loss. They also have strong physical security methods, such as cameras, armed guards, and alarm systems, to protect your gold investments.

Direct vs. indirect rollover: what’s the difference?

The direct rollover method is the best approach for rolling over funds from your retirement portfolio, but you can also use an indirect rollover. In this scenario, the funds come to you first, and you have 60 days to deposit them into your Gold IRA.

If you miss that window, the IRS treats it like a withdrawal, which could trigger taxes and penalties. There’s also automatic withholding of 20% unless you make up the difference when you deposit the funds. Most investors choose a direct rollover to avoid the hassle and risk.

Direct vs. indirect rollover

| Feature | Direct rollover | Indirect rollover |

| 60-day deadline | No | Yes |

| 20% withholding | No | Yes |

| Penalty risk | Low | High if late |

| Most common | Yes | Rare |

IRS rules and tax implications

If you use a direct rollover, moving your retirement savings over is straightforward and penalty-free. If you go with an indirect rollover, make sure you follow all the timelines and rules. As long as you stay within the limits, you won’t face any penalties.

Outside of the Gold IRA rollover process, the tax rules for a precious metals IRA are the same as those for any other IRA. You get the same contribution limits, tax benefits, and withdrawal rules. Your retirement funds just happen to be backed by physical gold instead of stocks or mutual funds.

Here’s what you need to know:

Contribution limits

The IRS contribution limits for 2026 are:

- $7,500 per year if you’re under 50

- $8,600 per year if you’re 50 or older

You can’t contribute more than your earned income for the year.

Taxes while the gold is in your self-directed IRA

If you’re using a traditional Gold IRA, your gold grows tax-deferred. You won’t pay anything on gains until you start taking distributions.

If you’re using a Roth Gold IRA, you’re contributing after-tax dollars. But if you follow the rules, which require you to be at least 59½ and have the account open for five years, your withdrawals are completely tax-free.

As long as the gold stays in your self-directed IRA account, you don’t owe any capital gains or income tax.

Withdrawals and distributions

If you take money out before age 59½, the IRS adds a 10% early withdrawal penalty, unless you qualify for an exception. Either way, traditional IRA withdrawals get taxed as regular income.

Once you turn 73, the IRS requires you to start taking distributions from a traditional Gold IRA. These are called Required Minimum Distributions (RMDs). If you miss them, there are tax penalties.

Roth IRAs don’t have RMDs during your lifetime, and as long as you’re at least 59½ and the account has been open for five years, your withdrawals are tax-free.

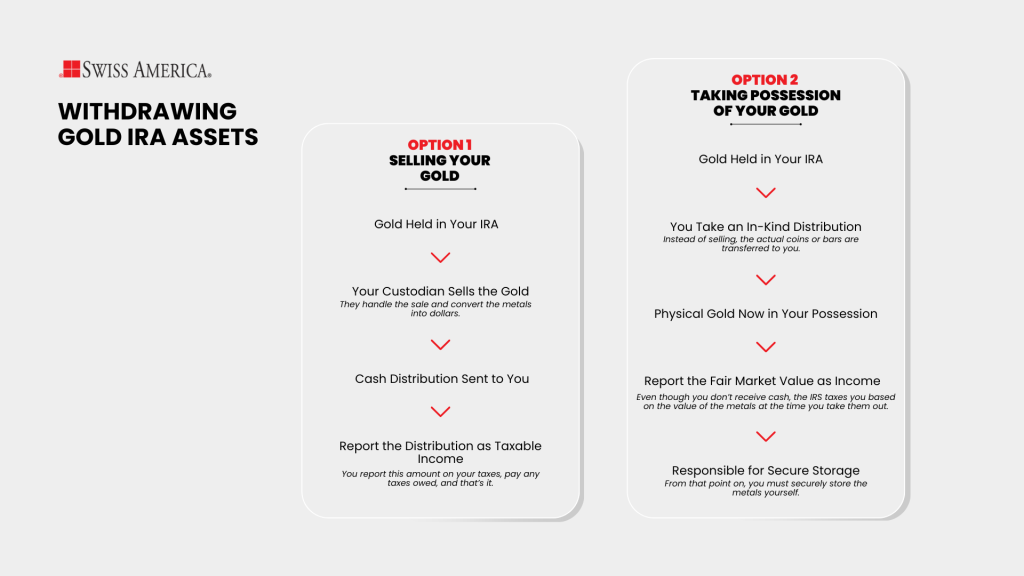

When you’re ready to withdraw, you can take distributions in two ways. You can sell your gold investments and take the cash, or you can request an in-kind distribution and have the physical gold or other metals shipped directly to you.

Choosing a reputable Gold IRA company

Choosing the right Gold IRA company comes down to doing some research. You want a firm that’s been in business for decades, has consistently strong customer reviews, and is part of trusted industry groups that focus on precious metals. That’s the baseline.

From there, look at what kind of IRA services they offer. Your chosen Gold IRA company should handle the rollover process from start to finish. That means:

- 401 k to gold: Explaining how you move funds from your existing retirement account.

- Account administration: Working with a Gold IRA custodian who holds the assets.

- IRS-approved metals: Helping you understand which gold and other precious metals qualify for an IRA.

- Storage: Coordinating shipping of your physical gold and precious metals to storage at an IRS-approved depository.

You also want transparency on fees for precious metals IRAs. That includes setup fees, annual maintenance, storage costs, and anything tied to buyback or liquidation. Look for a trustworthy Gold IRA company like Swiss America that provides education on the process, ongoing support, and clear communication.

What kind of gold can I own in a Gold IRA?

Here are the details on what metals you can buy with retirement savings in your gold individual retirement account:

Gold coins or bars

Your Gold IRA investment account must hold 99.5% pure gold. The types of eligible products include:

- American Gold Eagle coins

- Australian Kangaroo/Nugget coins

- Austrian Philharmonic coins

- Canadian Maple Leaf coins

- Gold bars and rounds from approved refiners

Here are some examples of eligible gold coins and bars:

Silver coins or bars

Precious metals IRA-qualified silver must be 99.9% pure. You can hold:

- American Silver Eagle coins

- Australian Kookaburra coins

- Austrian Philharmonic coins

- Canadian Maple Leaf coins

- Mexican Libertad coins

- Bars and rounds from approved refiners

Example silver coins and bars include:

Platinum coins or bars

Eligible platinum must be 99.95% pure. Gold IRAs can include:

- American Platinum Eagle coins

- Australian Koala coins

- Canadian Maple Leaf coins

- Isle of Man Noble coins

- Bars and rounds from approved refiners

Platinum bars and coins you can buy include:

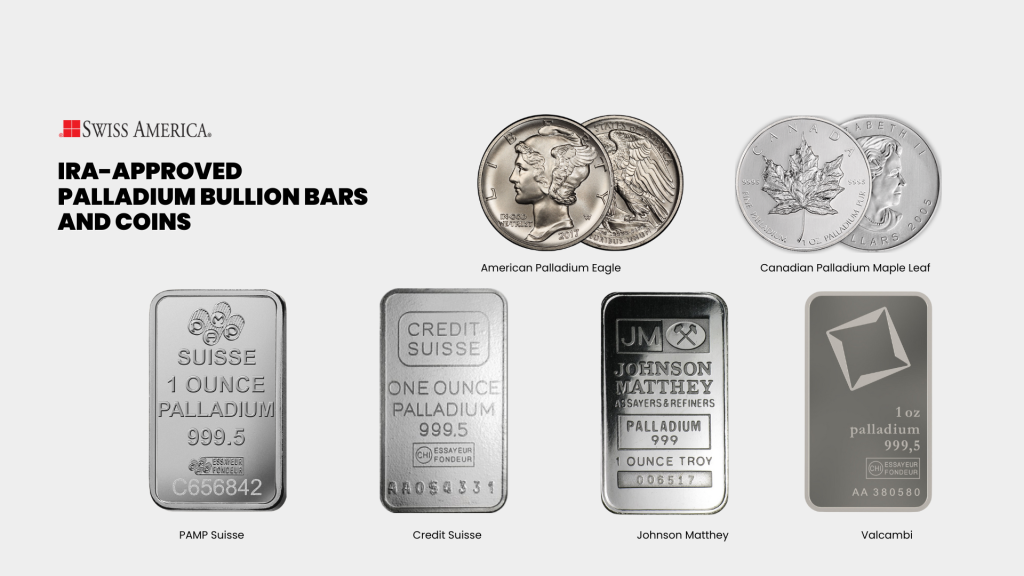

Palladium coins or bars

Palladium must be 99.95% pure. Gold IRAs can include:

- American Palladium Eagle coins

- Canadian Palladium Maple Leaf coins

- Bars from approved refiners

Palladium IRA-approved coins and bars:

All precious metals bars and coins must come from manufacturers accredited by at least one of the following organizations:

- NYMEX/COMEX: New York Mercantile Exchange / Commodity Exchange

- LME: London Metal Exchange

- LBMA: London Bullion Market Association

- NYSE/Liffe: New York Stock Exchange / London International Financial Futures Exchange

- TOCOM: Tokyo Commodity Exchange

Precious metals IRAs can’t hold rare or collectible coins, and the metals must be in their original mint packaging or accompanied by a certificate of authenticity.

The IRS updates the list of approved metals periodically, so work with experienced gold IRA companies like Swiss America for guidance around current regulations.

Costs and fees of Gold IRAs

There are fees associated with physical gold investment and Gold IRA rollovers that you should consider as part of your overall retirement savings plan.

- Setup and annual maintenance fees: There’s a one-time fee to set up a new Gold IRA account, which can range from $50-$100 depending on the custodian you choose. You’ll also have annual maintenance fees, which can be $75-$300 per year.

- Storage fees: Since your physical gold investments must stay within an IRS-approved depository, you’ll also have storage fees, which can be around $100 or more, depending on whether you go with commingled or segregated storage.

- Dealer markups or commissions: The price you pay when you purchase physical precious metals is different than the public spot price and will include premiums to cover costs like manufacturing and distribution.

- Buyback policies: Most reputable dealers will buy back your precious metals investments if you need to sell in the future. Be sure to ask about their policies and terms so you can factor this into your planning.

Common mistakes to avoid if you convert 401(k) to physical gold

Sometimes you’ll see stories about bad experiences with a Gold IRA or warnings about doing a rollover. Most of the time, it comes down to people not following solid guidance before getting started. Here are the mistakes to avoid:

Doing an indirect rollover and missing deadlines

As we’ve already shared, the best way to do a Gold IRA rollover is through a direct transfer. If you go with an indirect rollover, you open yourself up to possible taxes and penalties if you miss any part of the process.

Choosing unapproved gold

Work with a reputable dealer to make sure your precious metal investments meet IRS requirements. You don’t want to end up with something like collectible coins, which don’t qualify for a Gold IRA and could disqualify the account.

Using a custodian/dealer with bad reviews

Always, always, always check the reviews of any precious metals IRA company you’re considering. If they don’t have any reviews at all, be cautious. The best companies have been around for decades and have a track record you can verify.

Taking physical possession of IRA gold too soon

No matter what you read online, you cannot store your gold bullion at home if it’s part of a Gold IRA. Do not take possession of the metals before retirement age. That helps you avoid taxes and penalties.

Other ways to invest in gold besides a Gold IRA

You can also invest in paper gold assets through a traditional IRA retirement account. This includes gold mining stocks, exchange-traded funds, and gold mutual funds. These don’t involve owning physical gold, and they’re just regular market-based investments tied to the gold sector.

The drawback is that these investments have counterparty risk, and you have less independence from the stock market volatility than you do with physical gold.

There’s a category of physical precious metals you can’t hold in a self-directed IRA. These are collectible coins, also known as numismatic coins. The IRS doesn’t allow them in a Gold IRA because their value isn’t based purely on metal content. That makes them a riskier investment under IRS rules.

A quick comparison of the options include:

| Category | Pros | Cons |

|---|---|---|

| Gold ETFs | Easy to buy and sell. Low storage cost. Good liquidity. | No direct ownership of physical gold. Management fees apply. |

| Gold futures | High leverage allows larger exposure with smaller capital. Useful for hedging. | High risk due to leverage. Contracts expire and may require rollover. |

| Gold mining stocks | Exposed to company risks like poor management or rising costs. Moves with the stock market, not only the gold price. | Diversified exposure to gold-related assets. Professional management. |

| Gold mutual funds | Management fees. Performance depends on the fund strategy. | Management fees. Performance depends on fund strategy. |

Reputable gold IRA companies

The best Gold IRA companies have specialists who can help you move your retirement savings into physical gold coins and bars. For example, the Swiss America team helps with:

- Recommending trusted Gold IRA custodians for your self-directed Gold IRA.

- Helping you choose the right physical gold and precious metals based on your goals.

- Explaining the tax benefits and regulations to keep in mind.

- Sharing the costs and fees so you know exactly what to expect.

You can also learn more about Gold IRA investing with our free Gold IRA kit.

Final thoughts on converting 401k to gold

Most people turn to physical gold for the protection it offers. It’s a safe haven asset and a way to help preserve retirement savings. Using your retirement funds to buy gold can be a smart tax move and a way to diversify your portfolio for long-term security.

To learn more about investing in gold and other precious metals as part of your retirement plan, connect with the Swiss America team today.

401 k to Gold IRA without penalty: FAQs

How do I change my 401k to gold?

You roll over your 401(k) into a self-directed IRA that lets you hold physical gold. A Gold IRA specialist can help you handle the transfer and stay within IRS rules.

Can I cash out my 401k and buy gold?

You can, but you’ll likely owe taxes and a 10% penalty if you’re under 59½. A rollover into a Gold IRA is usually the better option if you want to avoid those costs.

How is gold taxed in an IRA?

As long as the gold stays in the IRA, you don’t pay taxes on gains. Traditional IRAs are taxed when you take distributions, while Roth IRAs offer tax-free withdrawals if you meet the requirements.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.